17.6 mln shares to be issued in proposed Main Board listing

KUCHING: Dayang Enterprise Holdings Bhd (DEHB) will issue 85.87 million new shares under its proposed initial public offering (IPO) on the Main Board of Bursa Malaysia.

A total of 17.6 million shares will be issued to the public, 8.5 million shares to its eligible directors, employees and business associates while 59.7 million shares will be placed out to identified investors.

DEHB yesterday signed the underwriting agreement with AmInvestment Bank Group for its listing on the Main Board. AmInvestment is also DEHB’s adviser and sole placement agent.

AmInvestment Bank executive director Pushpa Raja Durai said they are planning to raise RM125 million funds for DEHB to run its operations.

DEHB deputy chairman James Ling said the company’s listing marked a milestone for them because after 27 years as a successful oil and gas services provider, it was now able to share its achievements with the public and institutional investors.

He said DEHB had established itself as a major provider of offshore platform services with a list of impressive clienteles including Petronas Carigali, Sarawak Shell, Sabah Shell, ExxonMobil, Murphy Sabah Oil Co Ltd and others.

“To date, DEHB has completed various contracts totalling some RM934 million with ongoing contracts worth approximately RM627 million. The durations of the contracts are between one and five years.

“But we are not a company which rests on its laurels; in fact we have today tendered for contracts amounting to some RM595 million,” said Ling, who rated the chances of getting the contracts as 70 per cent.

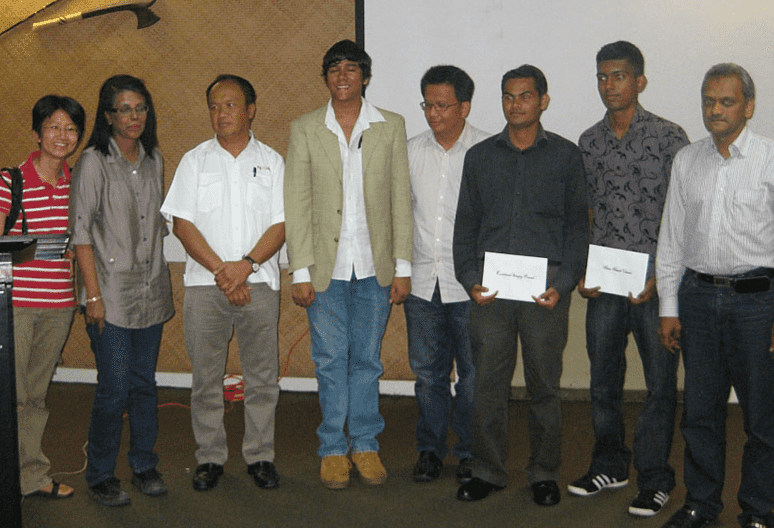

The signatories of the agreement for DEHB yesterday were its executive chairman Datuk Hasmi Hasnan and Ling, while the financial institution was represented by AMMB Holdings Bhd deputy chairman Datuk Azlan Hashim and Pushpa.

The ceremony was witnessed by Second Planning and Resource Management Minister Dato Sri Awang Tengah Ali Hassan, who is also the Public Utilities Minister.

Reviewing the history of DEHB, Ling said it is an investment holding company incorporated in 2005 but the company’s roots went back 27 years with the founding of the group’s subsidiary, Dayang Enterprise Sdn Bhd (DESB).

At the start of operations, he said the company ventured into trading of hardware material and supply of manpower for the oil and gas industry.

“Relentless in its pursuit for success, DESB expanded its services and in 1991 obtained its first contract from Sarawak Shell and Sabah Shell for the provision of maintenance services focusing on topside structures,” he said.

Ling said DESB is presently the single largest contributor to the group and for the financial year ending Sept 30, 2007, its business activities represented 52.1 per cent of the total group revenue amounting to some RM66.3 million.

He pointed out that two other DEHB subsidiaries were DESB Marine Service Sdn Bhd – which involves in the chartering of marine vessels – and Fortune Triumph Sdn Bhd which specialises in the provision of rental equipment.

“DEHB is ranked ninth amongst companies that undertake offshores topside maintenance services and hook-up commissioning services out of 59 companies in the country,” he said.

Ling also pointed out that DEHB was accredited with the MS ISO 9001:2000 Quality Management System by Sirim QAS International Sdn Bhd.

He said to date the company had received 14 awards including recognition for stellar operational and Health Safety Environment (HSE) achievements, safety excellence, Zero lost time incidents and a good safety record.

Ling added that they are deter-mined to maintain the best practices of operational performance to achie-ve high standard of HSE all the time.

He said they are in the proper position to offer shares to the public and believed that the shareholders, customers and users will be rewarded with valuable services, long-term growth and an increase in shareholder value.

When asked if the increase of the price in crude oil would benefit DEHB, Ling said they would only benefit in terms of getting more work as oil companies who earn more revenue from higher oil price would spend more money to maintain their platforms.

Meanwhile, Azlan believes that with the positive outlook for the oil and gas industry, the management team is well poised to bring DEHB to greater heights after its listing on Bursa Malaysia.

He added that with the upcoming listing of DEHB, AmInvestment Bank Sarawak Branch has successfully advised and listed 18 Sarawak-based companies on Bursa Malaysia, representing over 50 per cent of total Sarawak-based companies listed on Bursa Malaysia.

(Taken from Borneo Post)

Related Info: http://www.theborneopost.com/?p=32545