KUCHING: Naim Holdings Bhd has doubled its property development segment’s profit to RM54.9mil in the first nine months of this year, from RM26.9mil in the same period last year, thanks to robust sales of residential and commercial units.

The higher profit was achieved as total sales leapt by 34.2% to RM208.1mil from RM155.1mil. Sales from new properties rose to RM260mil from RM233mil in the same period.

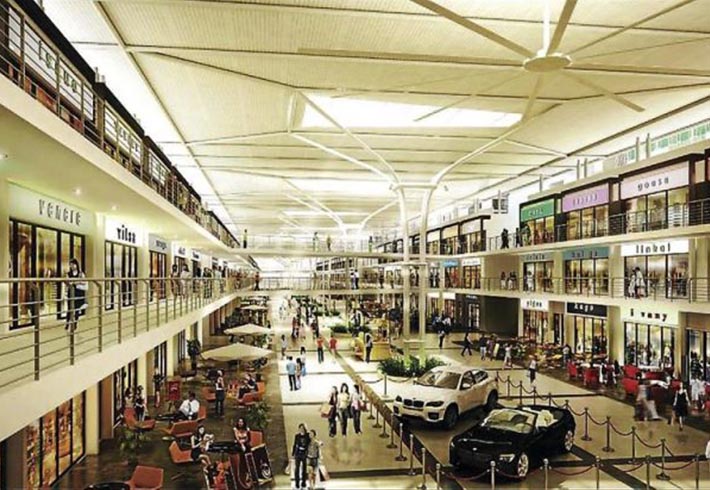

Naim said the group’s first commercial project in Bintulu — Bintulu Paragon — had raked in sales of an estimated RM90mil, including from booking units.

“Response to Bintulu Paragon, comprising a street mall and SoVo (Small Office Versatile Office), continues to be encouraging. Phase I of this development is expected to generate a gross development value (GDV) of RM1bil.

“We expect this project to contribute positively to our group results in the next two years when progress of the construction activity is accelerated,” the leading property developer said in notes to its latest quarterly results.

In the third quarter to Sept 30, 2013, group revenue shot up to RM192.1mil, an increase of 58.7mil or 44% from RM133.4mil in the same quarter last year. Group pre-tax profit was, however, lower at RM24.5mil from RM30.5mil. Earnings per share slipped to 7.96 sen from 12.26 sen.

On a nine-month profit, group revenue soared to RM505.9mil from RM348.2mil a year ago but group pre-tax profit dropped to RM87.4mil from RM90.3mil.

Naim said continued solid demand was recorded for properties in new launches of its flagship development — Bandar Baru Permyjaya — in Miri which remained as the top performer in both sales and gross profit contribution.

It said the matured new township with a 600,000 population had generated consistently 70% of group property profit and 50% of group gross profit since the listing of Naim on Bursa Malaysia.

On the performance of the group’s construction segment, Naim said higher works progress pushed its revenue higher to RM264.7mil in the first nine months this year from RM165.3mil previously.

However, the segment incurred a loss of RM28.3mil, a reversal from a profit of RM17.7mil in the Jan-Sept period last year due mainly to downward revision of the profit margin of the Fiji road rehabilitation project, and resettlement projects in Sarawak.

The Fiji project reported a RM15.6mil loss following a revision in the contract value arising from changes to the scope of work by the client following technical and contractual disagreement, higher than anticipated operational costs and lower productivity due to adverse weather, explained Naim.

“Despite the setback in the Fiji operation, we still forecast a minimal operational profit upon completion of the projects there. We also anticipate some gains to be realised from disposing of idling assets which are still ongoing.”

Naim said the RM12.7mil loss on resettlement projects was due to higher than anticipated logistics, materials and labour costs as the projects were in interior Sarawak, lower productivity because of inclement weather and the cost of “rescuing” non-performing sub-contractors.

However, Naim said the resettlement projects were expected to have an overall profit contribution to the group on their completion.

Naim said the group had secured new contracts worth RM665mil since last December, and this would contribute positively to its financials in the years ahead.

The group’s others segment (manufacture and sales of building and construction materials, hiring of equipment, provision of sand extraction and land filling services, quarry operation and property investment holdings) returned to black with a modest RM462,000 profit in the first nine months, from a loss of RM385,000 a year ago.

The segment’s revenue improved to RM33.1mil from RM27.8mil.

“We will continue to improve quarry, premix and sand extraction operations by putting in various measures to market and sell all products to achieve economies of economies and improve their performance,” said Naim.

On the performance of its associate company — Dayang Enterprise Holdings Bhd, Naim said the former reported impressive group net profit of RM125.6mil in the first nine months of this year.

Naim said its investment in Dayang was worth RM972.8mil based on its share price of RM5.26 as at Nov 27.

FROM: The Star Online (2 December 2013)

http://www.starproperty.my/index.php/articles/property-news/naim-holdings-bhd-looking-good/