KUCHING: Homegrown construction player Holdings Bhd (Naim) may be the ‘flavour’ of the sector soon, given the recent run up in share prices of larger contractors that benefitted small caps such as Naim.

According to investment bank-backed OSK Research Sdn Bhd (OSK Research), such outlook was further underscored by the group’s recent award of the RM2.44-billion Sabah Oil and Gas Terminal (SOGT) in Kimanis from Petronas Carigali – via Naim’s joint-venture (JV) with South Korean-based Samsung Engineering Co (Samsung Engineering).

“The SOGT will serve as a hub for crude oil and natural gas processing from the oilfields offshore Sabah,” noted the research house’s analyst Jeremy Goh in an online note yesterday.

Nevertheless, Goh felt that investors had somewhat ‘under-appreciated’ the significance of this recent win.

“Although the SOGT has boosted Naim’s orderbook by 70.8 per cent to RM1.76 billion, the reaction towards it has been rather ‘muted’, as its share price has risen by only 0.9 per cent since the announcement,” he observed.

Goh opined such ‘downplay’ response on the share price movementmight likely derive from execution concerns related to the SOGT.

“Such cautious sentiment is very much justified, given Naim’s minimal experience with the oil and gas (O&G) infrastructure.

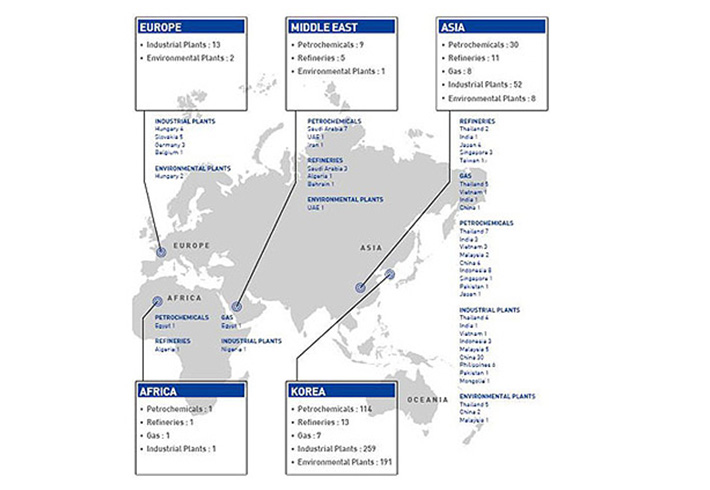

However, we draw comfort in knowing that the SOGT will be led by the group’s JV partner Samsung Engineering, which has significant experience in refineries,

petrochemical plants and LNG (liquefied natural gas) plants.

“As far as Naim is concerned, the group’s role will mainly centre on the SOGT’s support infrastructure like roads, bridges, earthworks and site offices – all of which are within Naim’s repertoire. Overall, the management is guiding for gross margins of 15 per cent from the job, while we are assuming 10 per cent at profit before tax level,” he elaborated.

Moreover, OSK Research viewed Naim as the best proxy to Sarawak’s infrastructure ‘theme’ play, of which the state’s contracts awarded to listed contractors was worth about RM1.26 billion year-to-date – a healthy increase of 33.2 per cent year-on-year.

“We think that contracts in the state will accelerate moving closer to the state elections, which may likely be held sometime in early 2011. Within its pipeline, Naim holds a letter of intent (LOI) for the RM1.3-billion Kuching flood mitigation, in which it has a 50 per cent stake,” stated Goh.

With regards to the project, the analyst said its Phase 1, valued at RM149 million, had been completed while Phase 2, which ranged in value between RM200 million and RM250 million could be awarded early next year.

“Naim also holds an LOI for an equipment supply contract to an education institution worth about RM100 million. There is also an RM160-million resettlement village job for residents affected by the Bengoh Dam, as well as a proposal by Naim to be in the running for a Universiti Teknologi MARA campus in Sarawak via PFI (private financing initiative).”

Looking ahead, OSK Research had made no changes to its forecast for Naim, even with the incorporation of the SOGT award into the group’s projected earnings for fiscal years 2011 to 2012.

“While Naim’s earnings growth will be rather minimal this year at 2.7 per cent, we expect that for fiscal 2011 to be a stronger 29.4 per cent, driven mainly by the group’s existing jobs gaining momentum, its Fijian jobs moving from losses back into the black and correspondingly, expected contributions from the SOGT.

“Our target price (TP) on Naim remains at RM5.09 per share. Excluding the SOGT, our 2011-2012 earnings would be pared down by seven to 10 per cent, resulting in TP to RM4.71 per share. Even under this scenario, there would be sufficient upside to warrant a ‘buy’ rating on Naim, hence the ‘flavour’ of the sector’s take on the group,” said Goh.