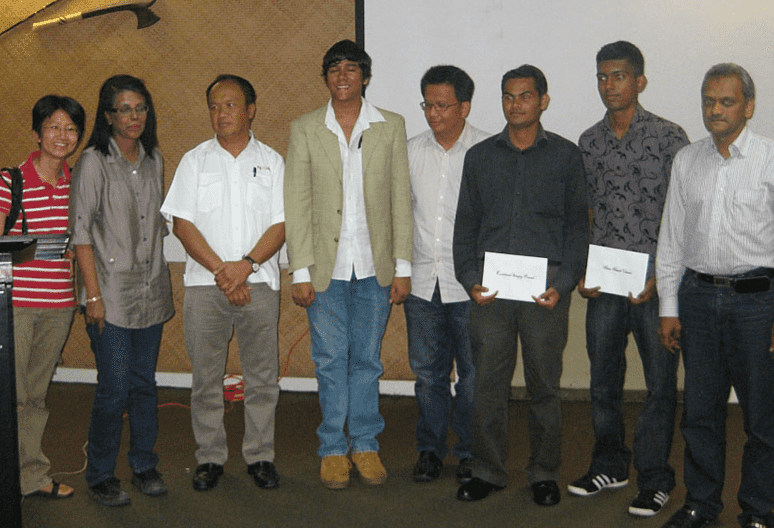

TWO-FOLD STRATEGY: Abdul Hamed and Hasmi (right) responding to queries by a MSWG representative during the group’s AGM at Wisma Naim. The group plans to redouble its efforts to secure new businesses that will include both local and overseas jobs.

KUCHING: Homegrown conglomerate Naim Holdings Bhd (Naim) will continue to revise its order book target previously outlined in its 2007-2011 Business Development Plan.

Its managing director Datuk Hasmi Hasnan disclosed that the RM7 billion target worth of new contracts acquired during the period had been an ambitious target, added with ongoing challenges seen across the economic landscape.

“We haven’t achieved that (target) yet, most likely we’ve reached more than 50 per cent. We’re a bit disappointed. Nevertheless, we’ll continue our effort to revise the target,” he said when met by The Borneo Post after the group’s 8th annual general meeting (AGM) held at Wisma Naim near here yesterday.

“That target was our old plan, whereas the new plan now targets a higher number. At the same time, we’ll be more focused in property development, given the landbank that we now have.

“Rather than revising downwards, we’ll redouble our efforts to secure new businesses that will include both local and overseas jobs,” he added.

Last May, Naim began a US$40 million road-upgrading works in Fiji, the first foreign country it had ventured into. In addition, the group would also be evaluating potential projects slated under the 10th Malaysia Plan (10MP), which was announced last week.

“We’re also hoping to gain something big out from 10MP. We’re maintaining a guarded optimism. There’s still time for us to realise our expectations,” he said.

In a recent research note as regards to the 10MP, OSK Research Sdn Bhd had identified Naim as one of several shorter-term beneficiaries within the country’s construction and property development sectors.

For the year ended December 31 last year, Naim registered a profit of RM84.99 million on a revenue of RM566.92 million. In comparison, its profit almost reached RM83.07 million while revenue was about RM523.72 million.

Meanwhile, a number of queries were raised by a representative from the Minority Shareholder Watchdog Group (MSWG) during the AGM, among them were the reason for the absence of market value information of Naim’s associate company Dayang Enterprise Holdings Bhd (Dayang Enterprise) in the group’s ‘Annual Report 2009’.

Presently, Naim holds close to 40 per cent stake in the Miri-based provider of offshore platform services specifically for the oil and gas industry.

The group’s chairman Datuk Abdul Hamed Sepawi responded, “Investments in associate are subjected to impairment assessment. As there’s no impairment loss on the company’s investments in Dayang Enterprise, we believe that it’s not necessary to disclose the market value of the said investment, which is held for long-term.

“Nevertheless, we’re appreciative of the query by MSWG and have taken note of it, by which in the future, we’ll disclose the market value of our investment in the quoted associate for better transparency and disclosure,” he explained.

Further, Abdul Hamed stated that the market value of Naim’s investment in Dayang Enterprise was RM219 million as at Dec 31, 2009, compared with a value of RM88.7 million in 2008.

Another issue put forth by MSWG was Naim’s plan to revive its loss-making associates namely Syarikat Usahama Naim-RSB Sdn Bhd (Naim-RSB) and SINOHYDRONAIM Sdn Bhd (SINOHYDRONAIM).

To this, Abdul Hamed replied by saying that Naim-RSB had remained dormant since its incorporation. The associate was held under Naim Cendera Sdn Bhd, the group’s wholly-owned property development as well as civil and building contracting subsidiary.

“This company registered a loss after tax of only RM2 in 2009, of which we plan to liquidate it.

“SINOHYDRONAIM, which posted a loss after tax of RM3.421 million in 2009, was incorporated to undertake a construction contract that will be completed by this July. The board also intends to liquidate this company upon expiry of the project.

“For your information, these investments have been fully-impaired up to the cost of the investments,” he pointed out.