Review of Performance

The Group recorded revenue of RM531 million in the year under review as against RM423 million recorded in 2005, an increase of 25%. Profit before tax for the year was RM109 million against RM123 million achieved in 2005.

Contribution to revenue from the construction increased from 23% in the preceeding year to 50% in the current year.

Our provisional results for 2006 are slightly below expectations, with earnings of 28 sen per share compared to 32 sen in 2005. This is a little disappointing for all of us at the Naim Group, as it is the first and only time that we have performed below expectations in 11 years of operation. There were a number of factors affecting our overall performance, most important of which were delays in the commencement of two major construction projects, a general increase in building material costs (which have now stabilized) and a distinct softening of the property market in Kuching, particularly in the demand for high-end properties. The low and medium cost housing demand in Miri and the rest of Sarawak remained firm.

Unfortunately, the delays to the projects, the Bengoh Dam and the Sibu Matadeng Road, were beyond our control as they involved design and land acquisition issues which we have been working to resolve in partnership with our client, the Sarawak State Government. Both projects are expected to commence in the near future and contribute to revenues for 2007 and beyond.

Prospects for 2007 and beyond

(The prospects for 2007 and beyond should be read in conjunction with the cautionary statement on page 4)

Property

On the property front, we expect 2007 to be another successful year. We have been aggressively expanding our land bank and are close to concluding the acquisition of six strategically located land packages in fast-growing urban areas, with a total area of approximately 660 acres. Using conservative calculations, this represents a possible GDV of RM1.7 billion. Adding this to our existing 2,400-acre land bank with its estimated GDV of RM3.1 billion, we will have a land bank of 3,100 acres with a total estimated GDV of RM4.8 billion.

This expanded land bank will allow us to further strengthen our position as Sarawak’s leading developer. According to leading property consultants CH Williams Talhar Wong and Yeo Sdn Bhd, the average annual demand for new residential properties in Sarawak will be around 15,800 per annum between now and 2010. In our target markets, this breaks down into 5,200 new homes per annum in the Kuching/Samarahan area, 2,800 new homes per annum in the Bintulu area, and 2,700 new homes per annum in the Miri area. Our projections suggest that we can capture at least 3,000 of the 5,200 annual demand in Kuching, 2,000 of the 2,700 demand in Miri, and 1,000 additional homes in Bintulu. In other words, we have sound reasons to believe that we can achieve the construction and sale of over 6,000 new homes per annum by 2012.

We continue to have great confidence in Sarawak’s property market, for a variety of reasons, of which two stand out as being the most significant.

1. Population Growth: Sarawak’s young, ambitious and upwardly mobile population is growing at between 3% and 5% per annum in urban areas and 2.5% overall, fuelled not only by a high birth rate, but also by substantial urban-rural migration as the state develops and industrializes (sources: Population & Housing Census Report, 9th Malaysia Plan). As a result, the state has the third highest level of overall housing requirements in Malaysia, at 65,000 units between 2006 and 2010. The only states with greater housing needs, namely Selangor and Johor, have far larger populations and thus Sarawak enjoys the highest per-capita demand of the three (source: 9MP, Credit Suisse)

2. Spin-Offs from Mega-Projects: A number of major infrastructure projects, including the Bakun Hydro Dam and other proposed hydro projects, Malaysia’s largest pulp and paper mill, and a proposed aluminium smelter, as well as the dramatic expansion of the oil and gas industry, will not merely provide secure and well-paying jobs for potential home buyers. They will also involve huge capital injections into the state’s economy, enriching local entrepreneurs across a wide range of categories and providing liquid cash for property and real estate investment.

Construction

We are equally confident of increased growth and profitability in our construction and civil engineering activities, again for a variety of reasons. For example, the delay in the Bengoh Dam project has led to the issue of a new Letter of Intent by the State Government, upgrading the contract to Design and Build. This will increase the overall contract value, and will also allow us a freer hand in the implementation of the project. Our ongoing projects (with a total contract sum of almost RM2.2 billion) continue to hit their respective targets either on schedule or ahead of schedule, and are expected to contribute to profits as previously forecast. They will also allow us to establish an important milestone for the group, as we look forward to a grand total of RM1.5 billion (including construction for in-house projects) of contracts completed by April of this year. Finally, work has now started on the RM620 million Syarikat Perumahan Nasional Berhad housing project with sites in Kuching, Kota Samarahan and Miri, which is expected to contribute to profits starting this year.

For the medium term, profits should be boosted by a number of major new contracts. Most important of these is the Kuching Flood Mitigation Scheme for the Drainage and Irrigation Department, Sarawak, for which a Letter of Intent has been received. According to the project design consultants, the scheme is likely to have a contract value in the region of RM1.6 billion (inclusive of land acquisition), although it may be implemented in stages depending on funding arrangements and other considerations. This project will be undertaken jointly with Ambang Project Management Sdn Bhd. In our opinion, the key factor in securing this high-value negotiated contract has been our solid track record of timely completion and excellent quality. With the award of this high-value, high-profile project, our total order book now stands at over RM3.5 billion. However full order books eventually become completed projects and therefore – in order to secure construction revenues and profits for the longer term – we are currently bidding for various major infrastructure projects, including oil and gas related projects, whose estimated value is RM8.0 billion over the next five years.

Please note that the order book value of RM3.5 billion given above includes projects at the Letter of Intent (LOI) stage. Given our track record and past experience, we are very confident that these LOIs will become firm orders, although this cannot be guaranteed.

To further increase the long-term value of our construction and civil engineering activities, as well as to minimize business risks associated with a comparatively narrow client base, we are seeking to diversify beyond mainstream government contracting and establish our presence in the rapidly expanding oil and gas sector. To this end we have set up a new Oil and Gas Division headed by our Senior Head of Construction, Gordon Kab, who has more than 15 years experience as a senior project manager with Shell Malaysia. We have already achieved the status of a Petronas-licensed contractor (Major Construction and Civil Works), and are in the process of upgrading this license to include M&E.

We have formed a consortium with international pipeline fabrication specialists including the world-renowned Nacap Group to bid for the upcoming Sabah-Bintulu Gas Pipeline project. This is a turnkey EPCC project with a contract value expected to exceed RM1 billion, whereby Nacap Group would provide the pipeline fabrication and implementation expertise and Naim Group would provide the civil works component, as well as our in-depth knowledge and experience of local terrain and conditions.

Cautionary Statement Regarding Forward-Looking Statements

This release contains certain forward-looking statements with respect to the financial condition, results of operations and business of Naim. These forward-looking statements represent Naim’s expectations or beliefs concerning future events and involve known and unknown risks and uncertainty that could cause actual results, performance or events to differ materially from those expressed or implied in such statements.

Written and/or oral forward-looking statements may also be made in periodic reports to the Securities Commission, Bursa Malaysia, summary financial statements to shareholders, proxy statements, offering circulars and prospectuses, press releases and other written materials and in oral statements made by Naim’s Directors, officers or employees to third parties, including analysts.

Forward-looking statements involve inherent risks and uncertainties. Readers should be cautioned that a number of factors could cause actual results to differ, in some instances materially, from those anticipated or implied in any forward-looking statement. Forward-looking statements speak only as of the date they are made, and it should not be assumed that they have been reviewed or updated in the light of new information or future events.

Changes on the Corporate Front

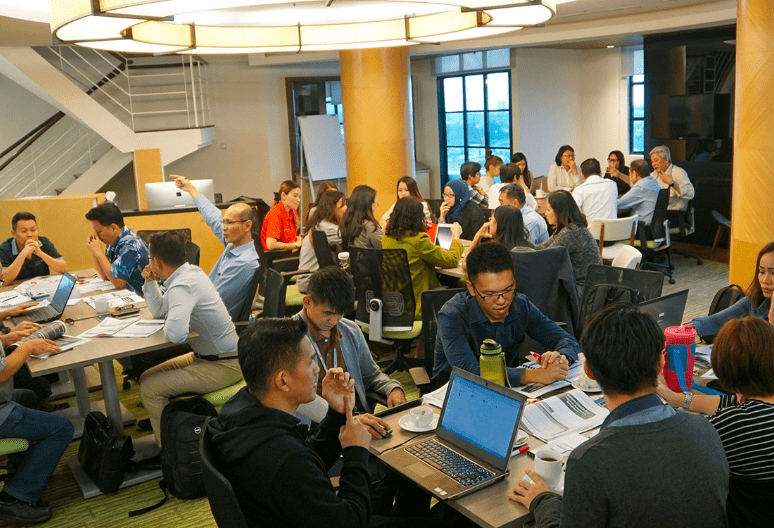

Over the past year we have been carrying out a far-reaching process of self-examination as part of our ongoing business process re engineering programme. In other words, we have been taking a long, hard look at how to build on our success and take the Naim Group to the next level of corporate performance. As a result of this period of self-examination and re-evaluation, we will be embarking on a management restructuring, process re-engineering and a comprehensive corporate communication and brand-building exercise which will start to bear fruit during the coming year.

Management Restructuring

In addition to being a provider of mass housing, we will be establishing a new division specifically to implement lifestyle housing in some of our strategically located properties. We will also be looking at oil and gas related activities, utilities, project management while at the same time strengthening our property investment division to prepare for REITs.

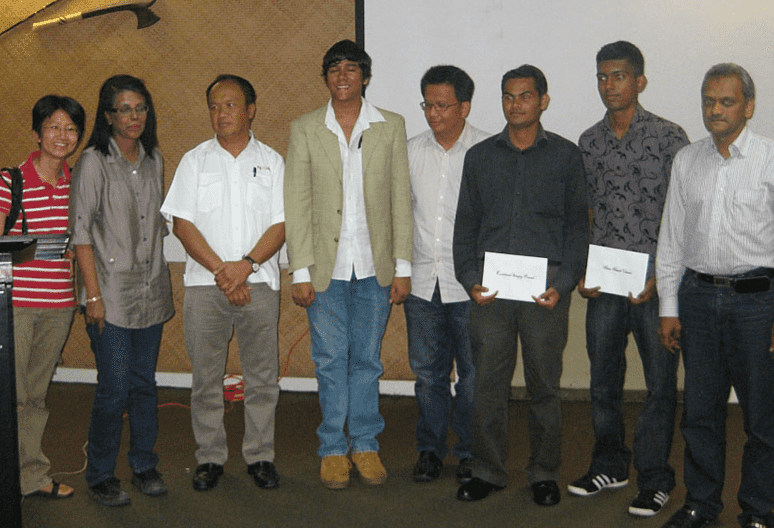

As the Naim Group has grown and expanded, we have become increasingly aware of the importance of consistent professional leadership and of having a clear programme of management succession. Therefore we have taken the decision to appoint a new Deputy Managing Director/Deputy CEO to strengthen our management team and prepare for the next level of growth. We are fortunate indeed, therefore, to be able to announce the appointment of Dr Sharifuddin Bin Abdul Wahab.

Most of you will need no introduction to Dr. Sharifuddin, who has already served as an Independent Non-Executive director since 2003. A corporate figure and hands-on leader of the highest calibre, he has a track record of continuous success as Chief Executive Officer of a multinational company with a presence in over ten countries in Asia. We are extremely confident that Dr Sharifuddin will provide the leadership skills necessary to take us to the next level of corporate achievement, and his appointment marks a further step towards our long term goal of implementing “Management by Professionals” in every area of our business activities.

To ensure continuity and to build on our existing achievements, Dr Sharifuddin will be assisted and supported by our current team of Executive Directors and Senior Managers. They include Ir Suyanto Osman (Senior Executive Director, Construction & Business Development), Ahmad Abu Bakar (Senior Executive Director, Finance and Operations), Gordon Kab (Senior Head of Construction), Vincent Kueh (Senior Executive Director, Property) and Radzali bin Alison (Head of Property Investment and Overseas Business). Their profiles can be viewed on our website at www.naimcendera.com

We will continue to recruit only the best people for the job in order to ensure that we can continue to provide the best products to our customers and stakeholders.

Corporate Image and Public Profile

As well as developing a more proactive approach to communicating with shareholders, other stakeholders and the general public, we will also be seeking to raise our profile in potential new markets. Of the various initiatives and activities we plan to undertake, probably the most important will be the opening of a new representative office in Kuala Lumpur in the second half of this year. In addition, we are planning to integrate and streamline all of our promotional activities in order to present a consistent and coherent set of brand values to our customers and to the public at large.

Corporate Governance Score

We at Naim Group have always believed that communicating transparently, candidly and effectively with shareholders is not only a duty, but also a powerful tool for building reciprocal trust, mutual respect and shared values. Therefore we were delighted with the findings of the 2006 Corporate Governance Survey Report, a joint study by the Minority Shareholder Watchdog Group and the University of Nottingham Business School. The report, based on a survey of the top 200 companies by market capitalization, ranked the Naim Group top among Sarawak-based companies listed on Bursa Malaysia for compliance with local and international corporate governance principles and best practices. Although we were only listed 3½ years ago, we were also ranked amongst the top 10% of all Malaysian companies, were second overall in the property sector, and were one of only four companies in Malaysia to provide detailed disclosure of Directors’ remuneration.

A Final Word

We look forward with confidence to double-digit growth over the next three to five years, and to continuing prosperity into the foreseeable future.